Some Ideas on Hsmb Advisory Llc You Should Know

Some Ideas on Hsmb Advisory Llc You Should Know

Blog Article

The Buzz on Hsmb Advisory Llc

Table of ContentsThe 45-Second Trick For Hsmb Advisory LlcSome Known Factual Statements About Hsmb Advisory Llc Getting My Hsmb Advisory Llc To WorkHsmb Advisory Llc for BeginnersThe Buzz on Hsmb Advisory LlcAbout Hsmb Advisory Llc

Ford says to avoid "money value or irreversible" life insurance policy, which is even more of an investment than an insurance policy. "Those are extremely made complex, come with high payments, and 9 out of 10 individuals don't require them. They're oversold due to the fact that insurance coverage representatives make the biggest payments on these," he says.

Handicap insurance coverage can be expensive. And for those that opt for lasting treatment insurance policy, this plan might make special needs insurance coverage unnecessary.

How Hsmb Advisory Llc can Save You Time, Stress, and Money.

If you have a persistent wellness concern, this kind of insurance policy could wind up being important (Insurance Advisors). However, don't let it stress you or your savings account early in lifeit's typically best to secure a plan in your 50s or 60s with the expectancy that you will not be utilizing it up until your 70s or later on.

If you're a small-business proprietor, consider protecting your resources by buying company insurance coverage. In the occasion of a disaster-related closure or duration of rebuilding, service insurance can cover your earnings loss. Consider if a substantial weather condition event impacted your shop or production facilityhow would that impact your income?

And also, making use of insurance policy can sometimes set you back greater than it conserves in the lengthy run. If you get a chip in your windshield, you may think about covering the repair work cost with your emergency cost savings rather of your vehicle insurance. Why? Because utilizing your vehicle insurance coverage can create your month-to-month costs to increase.

Hsmb Advisory Llc Can Be Fun For Everyone

Share these ideas to safeguard enjoyed ones from being both underinsured and overinsuredand seek advice from a relied on specialist when required. (https://hsmb-advisory-llc-45375044.hubspotpagebuilder.com/blog/health-insurance-st-petersburg-fl-your-trusted-coverage-partner)

Insurance coverage that is purchased by an individual for single-person coverage or insurance coverage of a family members. The individual pays the costs, in contrast to employer-based health and wellness insurance coverage where the employer typically pays a share of the costs. Individuals may shop for and acquisition insurance from any kind of plans available in the individual's geographical area.

People and households might receive monetary assistance to lower the cost of insurance coverage premiums and out-of-pocket expenses, but just when enlisting via Link for Health And Wellness Colorado. If you experience particular modifications in your life,, you are eligible for a 60-day period of time where you can register in a private plan, also if it is outside of the annual open registration period of Nov.

The Best Guide To Hsmb Advisory Llc

- Link for Wellness Colorado has a full listing of these Qualifying Life Events. Reliant kids that are under age 26 are qualified to be consisted of as relative under a moms and dad's insurance coverage.

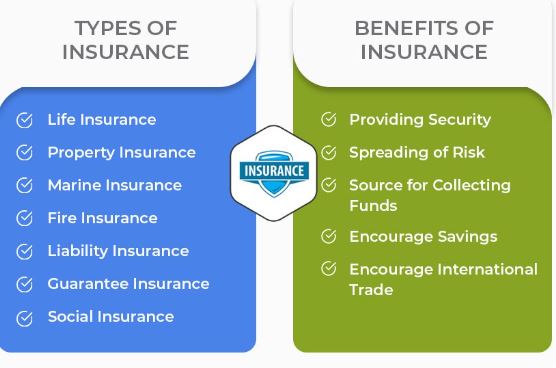

It may appear basic however recognizing insurance policy types can additionally be perplexing. Much of this complication originates from the insurance policy sector's recurring goal to create personalized coverage for policyholders. In designing versatile plans, there are a range to select fromand every one of those insurance policy kinds can make it tough to comprehend what a certain policy is and does.Excitement About Hsmb Advisory Llc

The very best place to start is to talk about the distinction between both types of basic life insurance policy: term life insurance coverage and permanent life insurance policy. Term life insurance policy is life insurance policy that is only energetic for a while period. If you pass away during this period, the individual or individuals you have actually named as beneficiaries may get the money payment of the policy.

Numerous term life insurance policy plans allow you transform them to a whole life insurance plan, so you don't lose insurance coverage. Typically, term life insurance coverage policy premium settlements (what you pay monthly or year right into your plan) are not locked in at the time of purchase, so every five or 10 years you have the plan, your costs might climb.

They also often tend to be less expensive total than entire life, unless you acquire an entire life insurance coverage policy when you're young. There are also a couple of variants on term life insurance policy. One, called team term life insurance policy, prevails among insurance policy alternatives you could have accessibility to with your employer.Rumored Buzz on Hsmb Advisory Llc

One more variant that you may official source have accessibility to with your company is additional life insurance policy., or interment insuranceadditional coverage that might aid your household in case something unforeseen happens to you.

Irreversible life insurance just refers to any life insurance plan that doesn't end.

Report this page